How to select the Best PCI DSS service provider

PCI DSS service provider | 5.imimg.com

Today’s world is called a digital one. Most of the day-to-day work is now done online including shopping, transactions, bookings, etc. However, this digital world has also created a lot of issues like frauds and breaches. Many ill-minded people make use of the opportunity to earn easy money.

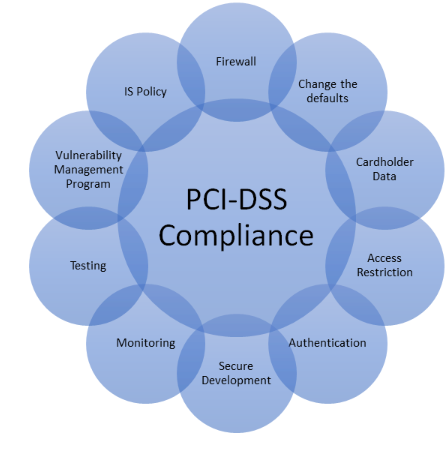

Certain options are available that the company owner or merchants opt for reducing the chances of these frauds or breaches. They follow the Payment Card Industry (PCI) Data Security Standard (DSS) standards. These are the standards that help to protect the cardholder’s data from falling into wrong hands thus, preventing frauds. The company or small business owners or the merchants approach the PCI DSS service providers to boost their business.

Importance of PCI DSS service provider:

As a company or a small business owner, they must make sure they are PCI DSS compliant. If there is any fraud or loss of cardholder’s data; it is the company’s responsibility. Theyhave to pay for any loss and may also have to pay heavy fine and compensation to the customer or cardholder. The reputation of the business and the confidence of the customer also depend on this PCI DSS compliance. Thus, it is of great importance that the company selects a good PCI DSS service provider which will, in turn, help their business to be safe and prosper.

Selecting PCI DSS Service Provider:

While selecting the best PCI DSS service provider, the company must consider some important criteria. The different questions or points which the company should consider while selecting the service provider include:

PCI compliance documents: The service provider should have valid PCI compliance documents. Once these documents are in place the company can check its security procedures.

Work experience: The service provider should have a good number of years to their work experience. This strengthens their knowledge of identifying and preventing frauds.

Past Breach or fraud experience: The company owner can ask the service providers if they have faced any cases of a data breach in the past. If yes, then how many data breach experiences they have and what are the steps they follow to minimize the data loss. The company can also enquire about the steps the service provider follows to prevent the loss of data.

Incident response plan: The owner can check the incident response plan which gives the written details about how the service provider will respond to the incidence of fraud or breach. It will also include the details related to procedures to identify the threats and also steps to recover from the breach.

Service provider information: The company should check the details about the service provider. They can check the client's recommendations. They should also check if there are any complaints filed against the service provider’s business. This will give some clear ideas about how the service provider handles the different issues and complaints.

Level of the service provider: The service providers are categorized into different levels based on the volume of the cards that they can process. Level 1 processes the maximum number of cards while level 4 processes the least number of cards. So the owner can the service provider based on their requirement or the based on their business.

Considering the above-mentioned tips to select the best PCII DSS service provider, the owner of the company can safeguard their business.